Plan Holds

Flexible Options for Your Clients

Sometimes life gets in the way, and your clients need a break from their plans. That’s where Plan Holds come in! With our flexible hold options, you can temporarily suspend payments on a plan, allowing your clients to return when they’re ready without losing any of their prepayments. Here’s how it works:

How Plan Holds Work

A hold temporarily pauses payments on a plan, crediting the remaining portion of the prepayment to the month when the hold is lifted. If the credit exceeds the amount due in that month, the extra balance rolls over to the next month's payment. If the credit doesn't cover the total amount owed, the client will need to make a separate payment, which will be prorated to cover the remaining days until the next scheduled billing date.

Example of a Hold in Action:

- August 1: Client pays $50 for a monthly membership.

- August 3: Staff places the plan on hold, scheduled to end on November 2. Only two days (August 1 and 2) are used from the $50 payment.

- October 10: Staff clears the hold early.

- November 7: The next billing date is 28 days from October 10. The client pays for November 7 through November 30, with an adjustment for the reduced billing period of $40 (calculated as $50 divided by 30 days multiplied by 24 days).

- December 1: The client pays the full $50 again and resumes the normal monthly billing cycle.

Key Points to Remember

-

Hold Start Date: If the hold starts on August 3, the plan will not be available for visits scheduled on that day. Pike13 will alert you if a paid visit is impacted by the hold.

-

Rollover Visits: If a hold is placed on a plan that allows unused visits to roll over, the hold extends the rollover period by the length of the hold. For example, a one-week hold on a monthly plan gives clients an extra week to use their rollover visits.

-

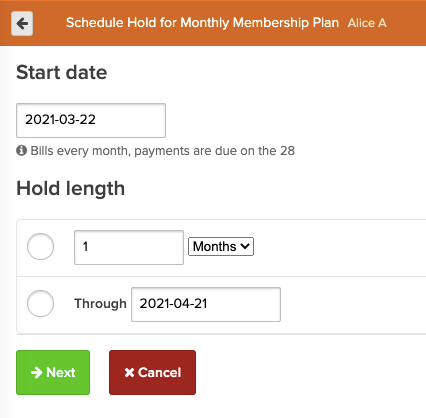

Flexible Hold Duration: You can set the hold duration in various ways:

- For a specific number of days, weeks, or months (ideal for vacations).

- Through a specific date (for known absences).

- Until cleared by staff (for indefinite holds, such as recovering from an injury).

-

Hold Fees: If applicable, a hold fee may be charged to help cover administrative costs associated with placing the plan on hold. Staff can adjust the hold fee during checkout if necessary.

How to Place a Plan on Hold

-

Navigate to Clients:

- At the top of any Pike13 page, select Clients.

-

Select Client:

- Find and click on the name of the client whose plan you want to hold.

-

Access Plans & Passes:

- In the right menu of the client's profile, select Plans & Passes.

-

Choose the Plan:

- On the Plans & Passes page, select the plan you wish to place on hold.

-

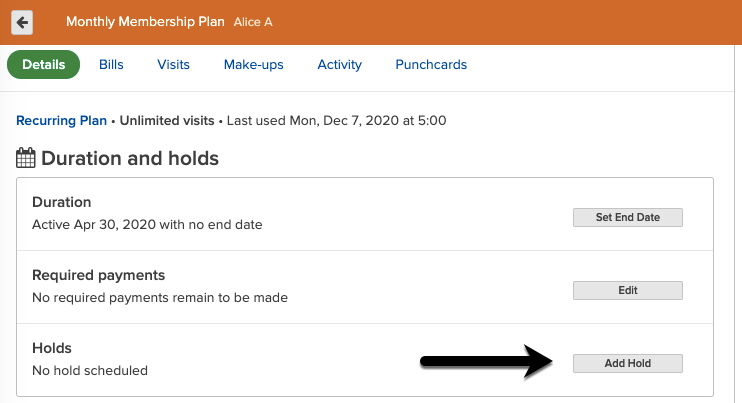

Add Hold:

- Under the Holds section, click Add Hold.

- Enter a start date, choose a hold length option, and select Next.

- Under the Holds section, click Add Hold.

-

Confirm and Process Fees:

- Click Go Back if changes are needed, then choose Confirm.

- If a hold fee applies, you’ll be prompted to process it in the shopping cart. Once paid, the plan will be placed on hold.

How to Remove a Hold from a Plan

-

Navigate to Clients:

- Click Clients at the top of any Pike13 page.

-

Select Client:

- Find and click on the name of the client for whom you want to remove the hold.

-

Access Plans & Passes:

- In the right menu of the client's profile, select Plans & Passes.

-

Choose the Plan:

- Select the plan for which you want to remove the hold.

-

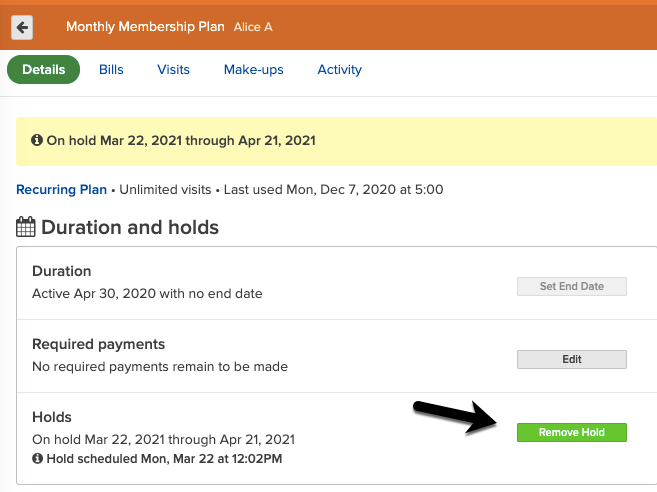

Remove Hold:

- Under the Holds section, click Remove Hold, then confirm by clicking OK.

Empower Your Clients with Flexibility

With Pike13’s Plan Holds, you can provide your clients with the flexibility they need, ensuring they feel valued and understood. This feature not only enhances customer satisfaction but also encourages client retention, making your business stronger!