Invoice Report

In-Depth Analysis of Your Billing and Revenue Streams

The Invoices Report is an essential tool for analyzing the intricacies of your billing processes, invoice statuses, and overall revenue. By providing a comprehensive overview of your invoices, this report enables you to create tailored views that highlight expected and unpaid amounts, categorize invoices by payer, and identify the number of autopay invoices, among other features. You can also filter invoices by various timeframes, including daily, weekly, monthly, or custom ranges, making it easier to stay on top of your financial health.

This report empowers you to keep track of your billing activities efficiently, ensuring that you have all the information needed to optimize your cash flow and make informed financial decisions.

Quick Views

New Invoices This Week - List of new invoices issued this week

Current Invoices Past Due - List of overdue invoices

Summary View

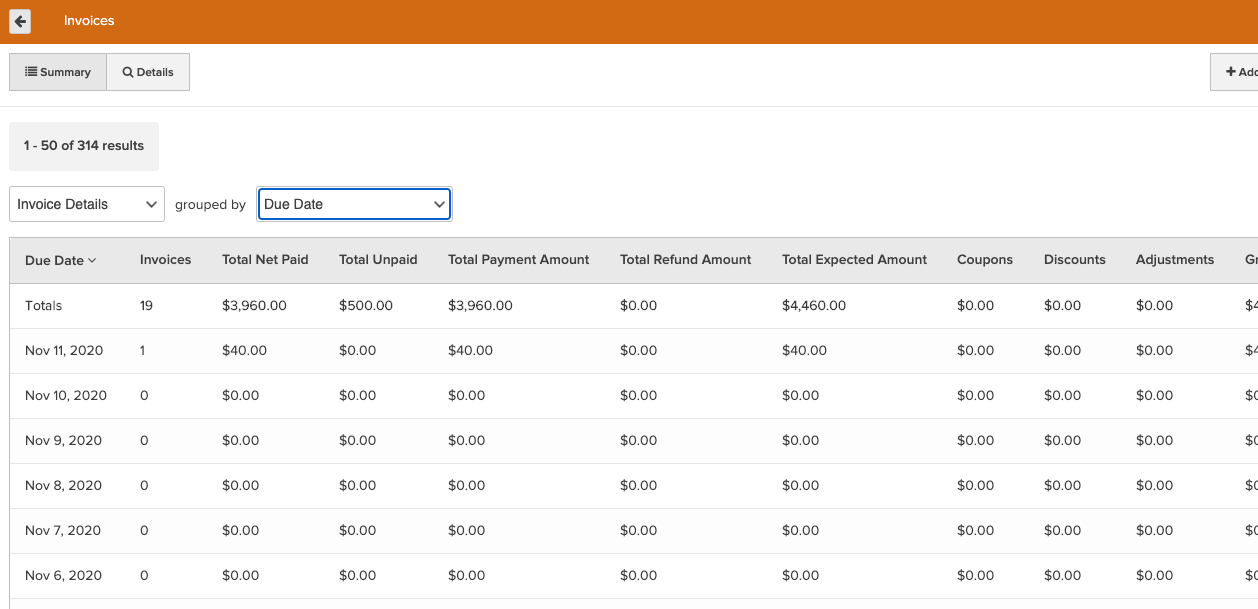

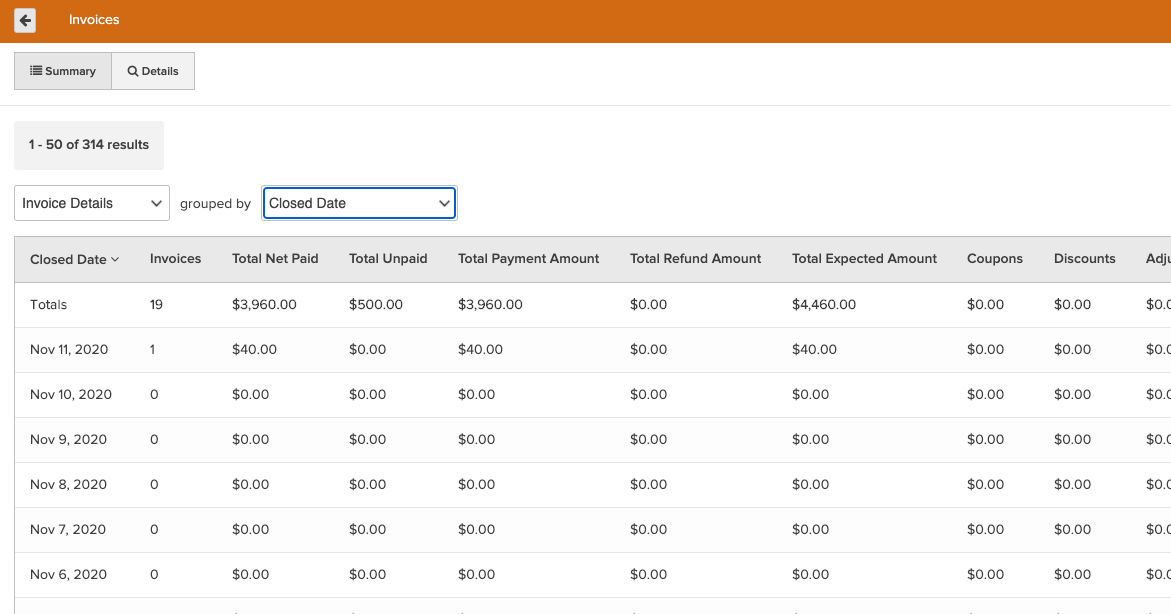

The Invoices report provides two summary views: Invoice Details, and Tax Related Details. Each view can be grouped by a set of provided invoice attributes.

The following metrics are computed for each group of invoices:

Invoices Details

- Invoices - The count of unique invoices.

- Total Net Paid - Sum of all successful payments less all successful refunds.

- Total Unpaid - Sum of all outstanding amounts to be collected.

- Total Payment Amount - Sum of all successful payments.

- Total Refund Amount - Sum of all successful refunds.

- Total Expected Amount - Sum of all amounts expected to be collected given discounts, coupons, adjustments and add-ons.

- Coupons - Sum of all coupon amounts applied.

- Discounts - Sum of all discount amounts applied.

- Adjustments - Sum of all non-discount and non-coupon adjustment amounts applied.

- Gross - Sum of all prices of the products at time of sale including inclusive taxes. Exclusive taxes, discounts, coupons, adjustments and add-ons are not included in this amount.

- Autopay - The count of unique invoices created as part of automated billing.

- Created by Client - The count of invoices created by clients.

Tax Related Details

- Invoices - The count of unique invoices.

- Total Net Paid - Sum of all successful payments less all successful refunds.

- Total Net Paid Less Tax - The portion of Total Net Paid that is not allocated to tax

- Total Net Paid Tax - The portion of Total Net Paid that is allocated to tax

- Total Expected Amount - Sum of all amounts expected to be collected given the discounts, coupons, and adjustments.

- Total Expected Less Tax - The portion of Total Expected Amount that is not allocated to tax

- Total Expected Tax - The portion of Total Expected Amount that is allocated to tax

Key dates

There are three key dates available for this report: Issued Date, Due Date and Closed Date.

Use Issued Date to group invoices by the day that they were created.

Use Due Date to group invoices by the day that they were due.

Use Closed Date to group closed invoices by the day that they were closed.

There are also corresponding options to group by Week, Month, Quarter, or Year. Issued Date, Due Date and Closed Date can also be filtered in the Details view to narrow down the window of time for review.

Details View

In addition to the summary view, there is also a Details view that shows greater details for each invoice. This view can easily be filtered to a desired timeframe, specific invoice statuses (such as closed transactions), payers, and more.

Available details in this view are:

- Payer - Full name of the person responsible for payment of the invoice.

- Invoice Number - Unique ID across all invoices for each business. For a franchise report, this number would not be unique, it is only unique at the business level. This is different from invoice_id in that invoice_id is unique across all invoices, not just those for this business.

- Due Date - Date when the invoice is expected to be paid. This is displayed in the timezone of the business.

- Closed Date - Date when the invoice was closed. This is displayed in the timezone of the business.

- Invoice Status - Current state of the invoice. Possible states include Open, Closed, Canceled, On Hold, and Purchase Request.

- Net Paid - Total amount of the successful payments less successful refunds.

- Unpaid - Total outstanding amount to be collected.

- Payment Amount - Amount of successful payments.

- Refund Amount - Amount of successful refunds.

- Expected Amount - Total amount expected to be collected given discounts, coupons, adjustments and add-ons.

- Coupons - Total amount of coupons applied.

- Discounts - Total amount of discounts applied. This does NOT include coupons or adjustments.

- Adjustments - Total amount of non-discount and non-coupon adjustments applied, such as price overrides or prorations.

- Gross - Price of the product at time of sale including inclusive tax. >Exclusive taxes, discounts, coupons, adjustments and add-ons are not included in this amount.

- Net Paid Less Tax - Portion of Net Paid that is not allocated to tax.

- Net Paid Tax - Portion of Net Paid that is allocated to tax.

- Expected Less Tax - Portion of Expected Amount that is not allocated to tax.

- Expected Tax - Portion of Expected Amount that is allocated to tax.

- Unpaid Less Tax - Portion of Unpaid that is not allocated to tax.

- Unpaid Tax - Portion of Unpaid that is allocated to tax.

- Autopay? - Indicates whether the invoice was created by automatic billing.

- Created by Client? - Indicates whether the invoice was created by the client.

- Issued Date - Date when the invoice was issued. This is displayed in the timezone of the business.

- Invoice Created By - Full name of staff or client who created the invoice.

- Commission Recipient - Full name of person receiving commission. Only provided when a commission recipient is specified at the time the invoice is created.

- Sale Location - Name of business location where the sale occurred.

- Failed Transactions - Count of unique failed transactions for this invoice.

- Refunded Transactions - Count of unique settled refund transactions for this invoice.

- Days since Invoice Due - Number of days since Due Date. Will be blank for invoices that are due in the future.

- Purchase Request ID - Unique ID across all purchase request, if applicable.

- Purchase Request State - Current state of the purchase request. Possible states include Open, Declined, Canceled, Expired, Purchased, or Not Application.

- Purchase Request Message - The purchase request message, if applicable (up to first 50 characters).

- Purchase Request Cancel Reason - When the purchase request is canceled or declined, the reason for cancellation or decline (up to first 50 characters).

- Primary Staff Member - Full name of invoice payer's primary staff member at time of sale.

- Payer ID - Unique ID for the person paying the invoice.

Why This Matters

Effective invoice management is vital for maintaining healthy cash flow and financial stability within your business. The Invoices Report provides a granular view of your billing status, enabling you to identify overdue invoices, analyze payment patterns, and understand revenue sources.

By leveraging insights from this report, you can proactively manage your collections, minimizing outstanding amounts and optimizing payment timelines. It also allows for better forecasting by understanding your expected revenues based on current invoices.

Whether you're a small business owner or part of a larger organization, mastering your invoicing process through this report can lead to improved operational efficiency, enhanced customer relationships, and ultimately, increased profitability. The Invoices Report is not just a financial snapshot; it’s a strategic resource that drives your business forward.